Top & Best Investment Broker Review 2022 – How to Select Ultimate Buyer’s Guide

Investment Broker: Which is the best of 2022?

If you want to see your money pay off more effectively, you’ve come to the right place. In today’s article, we’ll explain everything about what an investment broker is.

The investment broker is a financial institution that helps you invest your equity. But as there are many brokerages that offer products and charge different rates, you need to know how to choose the best one for you.

First, the most important

- The investment broker is the bridge between you and the product in which you will invest your money.

- It is possible to invest without the help of a broker, but this choice is not always the most profitable.

- Next, we’ll show you how to choose the best broker.

You may also like:

- Business insurance: How to choose the best in 2022

- Life insurance: how to choose the best one for you in 2022

- Real estate financing: What is the best of 2022?

Best Investment Brokers: Our Recommendations

- The best option for experienced investors

- The ideal investment broker for beginners

- The best broker to invest without fee

Hiring Guide: All About Investment Brokers

When you finally manage to collect a sum of money or you use it to buy a good, a service or research the best way to make that money pay off.

In such volatile times, when the market does not guarantee any stability, the safest way to see your money increase is through the intermediation of an investment broker. And that’s what we’re going to talk about next.

What is an investment broker and what is it for?

The investment broker, or securities broker, is a financial institution that is authorized by the Central Bank. broker the purchase and sale of financial securities.

In practice, each brokerage has a different quantity and variety of products in which you can invest your money.

With this, it is through the investment broker that you have access to Treasury Direct, investment funds, shares and etc.

In general, stock brokers offer two types of products for you to invest in: Fixed income and variable income.

But you are the one who chooses where, how and how much to invest in each investment, be it the most conservative, moderate or risky ones.

In addition to offering investment products, the broker can also offer support, information and guidelines for you to make investments according to your objective.

What is the difference between the investment broker and the bank?

There are basically two ways to invest your money: Through brokerages or traditional banks.

But the advantages of investing in a stockbroker are usually greater. This is because, through an investment broker, it is possible to have access to a greater variety of financial applications, for all budgets and tastes.

Banks only offer their own financial products, and therefore more limited. In addition, although some investment brokers charge fees on top of transactions, they are still lower than those charged by banks.

Another big difference is in the profitability of the applications. In general, banks tend to offer applications at lower rates, especially if the institution is large.

An example is savings that, despite being a safe application, have a very low real income.

The following is a summary of the main differences between the investment broker and the bank.

Is it possible to invest without a broker?

Yes, it is possible to invest without a broker. As we have seen, it is possible to invest in the bank in which you already have an open account.

To invest in Tesouro Direto, a financial institution must carry out the operation.

But you can also invest directly with the administrator of the fund or security, although this is not always possible.

For example, to buy at Tesouro Direto, a financial institution is required to carry out the operation.

In addition, if you want to invest in different assets at the same time, you will find it more difficult if you decide to do so without the broker. After all, the great advantage of investing through a broker is, in fact, the variety of products it offers.

What are the fees charged by brokerage firms?

The fees that an investment broker charges vary according to the type of service offered and may even be free.

For example, when it comes to investing in variable income, some brokers choose to exempt customers from charges. But this is not a rule.

Below are the main fees charged by an investment broker:

-

- Brokerage fee : It is charged for the intermediation service of transactions for the purchase and sale of financial investments and varies according to the type of operation.

- Bovespa Table: It is a fee charged to those who invest via the trading desk, when you contact the broker and ask an operator to execute the buy and sell orders.

- Custody fee: This is an amount charged to register and store investments in a person’s CPF, be they bonds or shares.

- Fees: These are fees charged by B3, Stock Exchange, and the Settlement and Custody Company (CBLC) to process transactions in the financial market.

- Income Tax: For those who invest in fixed income and investment funds, income tax is automatically collected. But anyone who invests in stocks or other variable income assets, must manually collect the tax every month.

It is worth remembering that stock transactions are exempt from Income Tax when the total sales volume falls below R $ 20 thousand per month.

How to hire and invest in an investment broker?

When you decide to make an investment through a securities broker, the first step is to open an account with the broker.

It works like this: You fill out a registration on the broker’s website and send the requested documents such as ID, CPF and proof of residence.

In general, this process can be done on the investment broker’s own website or by email.

In general, it is possible to start investing through a broker with amounts starting at R $ 30.

When your account is active, you can then transfer the amount you intend to invest, from your bank account to the broker’s account, through a TED.

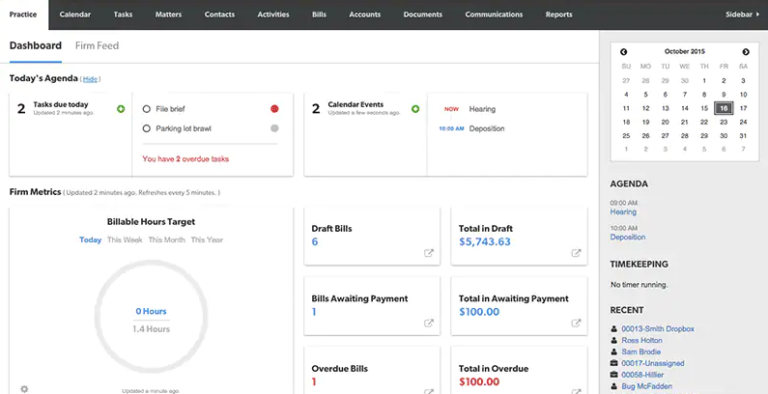

That done, you can then choose the product you prefer and start the investment. At this stage, the best investment brokers usually provide an online tool that tests your investor profile.

With the investor profile test, you are able to find out which is the best product offered by the broker for you to invest your money, according to your objective and expectation.

Some brokers also offer an investment simulator, which shows how much your money will pay off, in a given period of time, considering the asset you chose to invest in.

That way, you have even more information to decide how best to invest your assets.

When you choose where to invest your money, you must then inform the broker and authorize the transaction.

What are the types of investments of a stockbroker?

There are many types of assets or products available at an investment broker and each has its own specific characteristics and serves a different type of investor profile.

For example, some products are considered more profitable. On the other hand, these are the least safe, as they tend to oscillate the most.

That is, just as you can see your money pay off by investing it in a highly profitable asset, depending on the market you can also eventually lose money.

In general, the basic assets offered by an investment broker can be divided into two types: variable income and fixed income.

Other assets, on the other hand, are considered to be more stable and secure, but in general they are the ones with the lowest profitability.

But, to give you an overview of the characteristics of the main types of financial investments and their categories, check out a brief summary below:

Fixed Income

Fixed income investments are those considered safe and conservative. That’s because, they offer better predictability of financial return.

But, in addition, within fixed income, there are two types of investments: fixed and post-fixed. Pre-fixed rates have a fixed rate of return.

That is, in this case, you already know in advance exactly what your income will be when investing in this asset.

Income is post-fixed, in general, it has a yield rate linked to some correction index, such as CDI, Selic or IPCA.

In addition, there are several fixed income securities that you can invest in through a brokerage. The most popular are:

-

- Direct Treasury;

- CDB (Bank Deposit Certificate);

- LCI and LCA (Income Tax Exempt Letters of Credit);

- LC (bills of exchange);

- Fixed Income Funds .

All of these investments are credit securities issued by some organization such as the Government (Tesouro Direto), banks (CDBs, LCIs and LCAs) or financial (LCs).

Variable income

Unlike fixed income, variable income includes investments that have unpredictable fluctuations and that can be determined by several factors.

That is, when choosing a variable income asset at an investment broker, you need to be aware that the risk is greater.

But, precisely because it offers more risks, investment in variable income is also more likely to bring a much higher profitability when compared to fixed income securities.

The following are the most popular investments in this segment:

- Multimarket Funds ;

- Real Estate Funds ;

- Equity Funds ;

- COE (Structured Operations Certificate);

- Stock Market ;

One of the items that most interferes in the profitability or not of this type of investment is the law of supply and demand. For example, when a stock is much bought, its market value goes up.

Therefore, investing in funds and shares requires greater knowledge on the part of the investor.

In a simplistic way, to profit from this type of investment in a broker, it is necessary to identify the options that are not up, buy and wait for their possible appreciation.

Therefore, this type of investment is usually made by investors called aggressive.

Do you know the three types of investors? They are: Conservative, moderate and aggressive.

The conservative investor values security and high liquidity. For this reason, in general, conservative investors focus their assets on fixed income investments, which offer less risk.

The moderator is an investor who chooses the security offered by fixed income securities, but who also want to risk a little more to achieve a higher return on their investment in a brokerage.

Finally, the aggressive investor is the one who aims for maximum profit, at any cost.

For this reason, this type of investor chooses the investment funds of a broker that have a greater fluctuation, such as equities or foreign exchange, but which can result in greater profitability as well.

Hiring Criteria: How to Compare Investment Brokers

Before choosing the best investment broker for you, and starting to invest your money, you need to be aware of some aspects, from the authorized assets of each broker to the amounts charged.

For you to be more secure, we have listed below the main criteria you should consider:

- Authorized brokers

- Letter of assets

- Additional services

- Customer support

From here, we will explain in detail how to analyze each of these points.

Authorized brokers

The first factor that you should consider when choosing the best investment broker is its legality and suitability.

The operation of a securities broker is regulated by the and the Central Bank.

The broker must be authorized.

That is, the broker must be authorized to operate in the market.

But in addition, check online reviews and customer reviews. In general, trustworthy investment brokers have been around for longer and have information available transparently.

Letter of assets

Ideally, you should choose an investment broker that has a broad and diverse portfolio of assets.

While some brokerage firms are restricted to stocks, for example, others offer a range of products ranging from investment funds to insurance.

Additional services

Another important factor to be taken into account is that the best investment brokers offer additional services. Check out the main ones:

- Reports ;

- Interaction with other investors through a forum;

- Analysis tools ;

- Personalized advice ;

- Courses, lectures and educational materials .

Customer support

Be sure to consider how you receive support from the investment broker.

You will often need to ask questions and ask for help when making a decision regarding any type of investment. So, note what are the available communication channels.

abstract

The investment broker is responsible for making the middle ground between you and a variety of financial products in which you can invest your money in order to obtain a good return.

In addition, the investment broker can and should guide you and explain the difference between different types of products. However, the choice of where to invest your money will always be yours.

Therefore, choosing the best securities broker involves considering the assets the institution works with, the fees that are charged, as well as the legality and reputation of the broker.

top 10 stock brokers

top 10 brokerage firms

best stock broker for beginners

interactive brokers

best online stock broker for beginners

best brokerage firm

brokerage account

best online trading platform

What is the best stock broker for beginners?

Who are the top 10 brokerage firms?

Which broker is best for long term investing?

What is the best investment platform?

What broker does Warren Buffett use?

What is the best stock to buy right now?

Who is the best stock advisor?

What should a beginner invest in?

What is the best stock advice website?

How do I choose a broker?

Where should I invest money to get good returns?

How do I begin investing in stocks?

Is Ameritrade or Etrade better?

How do I begin investing?

Is my money safe in a brokerage account?